A Guide To Subscription Tax for Your Membership Site

Are you aware of the subscription tax for your membership site? Taxes can be overwhelming, but it's essential to run a successful business.

The subscription eCommerce market is projected to reach $473 billion by 2026. With its growing popularity authority also starts paying attention to subscription tax.

For years, companies are paid taxes via a broad range of income taxes to contribute to public expanses. But with changing landscape of the economy digital business comes into the spotlight.

Challenges also arise with the new concept of selling intangible products like subscription plans, online courses, online support services, etc. The challenge touches not only the local and border policies but also the privacy policy and information security, etc.

Your subscription business model must perform accurate calculations, collection, and remittance of sales taxes. This guide helps you to understand how taxes affect your business. And how you can integrate an automated system into your subscription business to handle all the tax calculations and reports efficiently.

Let's first start with the basic query –

What is a Subscription Business Model?

A membership website is a great option for both passive and recurring income online. Here you can offer gated content and exclusive benefits to your members. Often this type of website sells subscriptions so users get access to premium facilities.

A subscription website lets users pay a certain amount to use a product or service within a limited time period. It's a financial contract between the owner and the customers. Popular subscription business models include SaaS, digital publications, online courses, video & music streaming services, newsletters, etc.

Advantages of the Subscription Business Model:

- Predictable future revenue stream

- Ensure better customer relationship

- Boost customers loyalty

- Increase customer retention rate

- Great chance to earn more through up- & cross-selling

Some popular subscription business platform includes- Netflix, Hulu, Amazon Prime, Apple Music, Salesforce.com, Spotify, and others.

Why Subscription Business Model Becomes Popular

The subscription business becomes popular with both consumers and merchants for one main reason- convenience.

According to Gartner, 75% of organizations selling directly to consumers will offer subscription services by 2026. This means the subscription business model is here to stay.

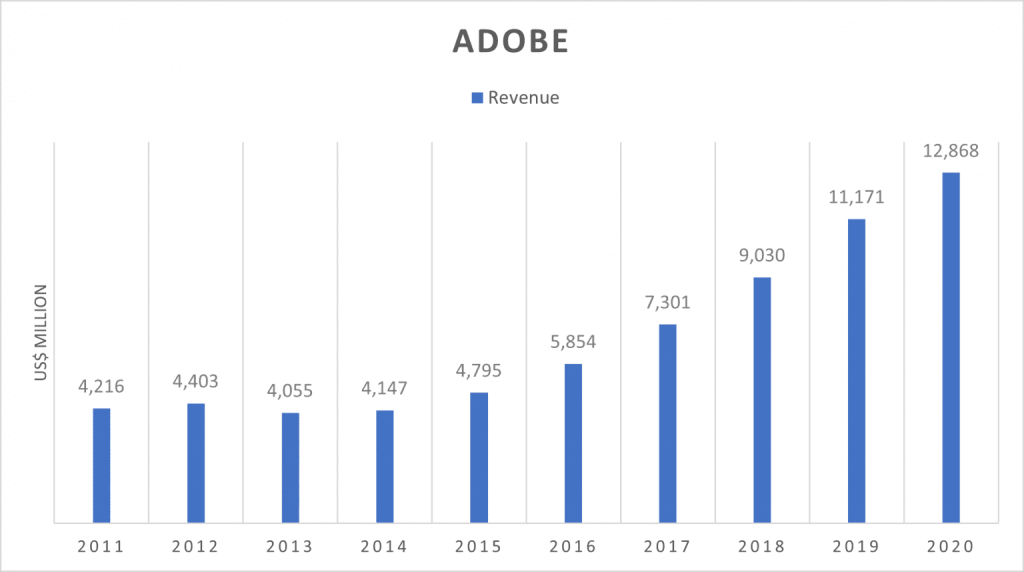

Adobe first introduced its subscription model in October 2011 and from January 2017 it turns into fully subscription-based. Since then Adobe's revenue has steadily climbed.

Inside a subscription business model, people get a convenient, personalized, and lower-cost way to buy their desired products or service on a recurring basis. This turns one-time customers to repeat customers. Also, they have the option to unsubscribe once they are done with it.

On the other hand, the bottom line of a subscription business is quite predictable and sustainable. This means businesses can easily predict their future growth and scale. And getting a chance to lock their customers for a long time period, retailers can improvise their products and services to match customers' needs.

76% of businesses claim that a subscription-based model helps create customer retention and long-term relationships with customers.

However, the Subscription billing model is beneficial for both sellers and buyers. But you have to take good care during tax calculations for recurring pricing models. If you have customers from different time zones or states, the tax rate would be calculated differently. This is crucial because a tiny mistake can cause a big penalty for your business.

Want to see examples of successful user-generated content campaigns? Check out these global winners – Top examples of successful user-generated content campaigns worldwide. 🌍🏆

Sales Tax for Subscription & Recurring Billing Models

A sales tax is a certain amount paid to a governing body for the sales of certain goods and services. It is a consumption tax that means customers only pay sales tax on taxable items they buy from retailers.

It's, however, comparatively easy to calculate sales tax for one-time purchases. But it becomes way more complex to figure out the amount for subscriptions and recurring billing.

Generally, every country has different rules for sales tax. Though sometimes it might vary within a country by state and province such as in USA or Canada. As a seller, it's your duty to pay or collect sales tax. Depending on your service area, you need to set the tax rate accordingly. Many people are unaware of it just because most sale taxes are self-regulating.

For example, Rhinebeck, New York follows a combined sales tax. These are the components of the Rhinebeck, NY sales tax rate:

| Tax Type | Number of Tax Rate |

| New York state sales tax rate | 4% |

| Dutchess Country rate | 3.75% |

| Dutchess Country District tax rate | 0.38% |

| The total sales tax rate | 8.13% |

To handle people from different geographical areas, you may follow foreign tax regulations for your subscription business. For example, taxpayers in Europe follow the VAT tax while Australian customers prefer GST.

Why You Should Be Aware Of Changing Tax Landscape

Subscription business models become popular in the tech industry, especially for SaaS (software as a service) companies. People are also getting the related things into consideration for a smooth transaction.

However, it's a little bit complicated to impose tax laws on your subscription packages. As these are not tangible properties so the regular taxation rules are not applicable to them.

Suppose you sell a product that should be subject to sales tax. But for any reason, you forget to charge your customer the sales tax. In that case, your customer will be responsible for paying the sales tax due to the appropriate tax authority.

And this may happen frequently if you don't integrate an automated system into your billing process. Evidently, it's not good for your business reputation.

If you pay attention to the new regulation of the EU, it instructs online sellers to charge EU VAT who sell digital products or services to EU customers. As a seller, you must collect, report, and remit taxes locally. But your responsibility doesn't end here, you have to file a return for the EU taxes you are supposed to collect from your customers.

Read More: How to Apply EU e-Commerce Regulations on Your WooCommerce Marketplace.

Common Challenges with Subscription Tax

As we've mentioned above, a subscription business is a great way of income on a periodic basis. With this, a company can go out from a one-time income and users get hundreds of benefits. But at the same time, recurring billing can create a risk of recurring sales tax.

Let’s unpack the challenges with subscription tax:

Finding Sales Tax Liability

If you sell subscriptions in multiple states, it becomes difficult to figure out where your company has a sales tax liability (nexus). This is also time-consuming and costly to track changing rules and rates over the boundaries.

Different Tax Rates Based on Location

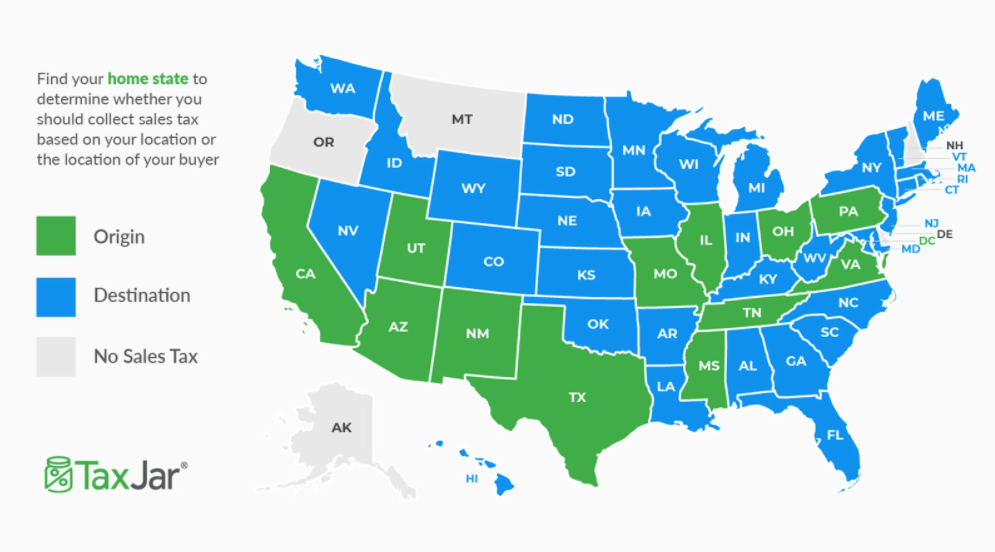

You can calculate your subscription tax based on its source or method of delivery. Maximum states are origin-based where sales tax is charged based on the origin of the transaction. Others determine the tax considering customer destinations. And a few states follow a combination of rules.

Knowing The Exact Location of Customers

In order to charge the appropriate sales tax amount, you need to confirm the reallocation of the user. It might be challenging as the subscriber could live in one state but include a billing address from another state.

Managing Sales Tax Holiday

Sales tax holidays allow users to buy goods and services tax-free on special occasions. But sometimes customers don't understand that and expect a sales tax break on their next purchase. Also, if you can't apply holiday tax breaks properly it may cause over-charging sales tax.

Later, you may invest additional costs in time and effort to correct the errors and refund the over-collection to your customers. Many companies don't have the potential to handle sales tax holidays for specialized products like digital downloads or membership.

Sales Tax-exempt Transactions

Depending on the rules in your taxing jurisdiction, some customers don't need to pay sales tax. For subscription tax, you need to account for customers' tax status or the taxability of the product. Most often subscriptions sold to nonprofits are tax-exempt.

But still, you need to pay a use tax in most jurisdictions. In order to mitigate the audit risk, apply an effective and efficient tool for monitoring, filing, and verifying the certificates.

Developing an effective recurring billing strategy with proper subscription tax can be a daunting task. A powerful tool can help you out by eliminating unnecessary work and automating the process.

Simplify Your Subscription Tax Liability With WP User Frontend

WP User Frontend is a powerful tool that enables you to build a highly functional membership website in minutes. It offers many exclusive features like creating premium subscriptions, content restriction, frontend posting, and others. Along with these features, this plugin makes tax configuration easier for you.

With the dynamic tax settings feature, you can set up custom country and state-wise taxes in a few clicks only. Even it lets you define a certain amount of tax rates for those who do not belong to any countries and states listed in the plugin.

In order to set up tax rates for the subscription packs then first need to create subscription packs. You can do it by going to WP-Admin → User Frontend → Subscription → Add Subscription. Check this detailed documentation to learn how to create subscription packs.

How to Set Up Tax On Your Subscription Plans

Now to set the tax for subscription plans, you must have:

- WPUF FREE 2.8.5, and

- WPUF PRO 2.8.1

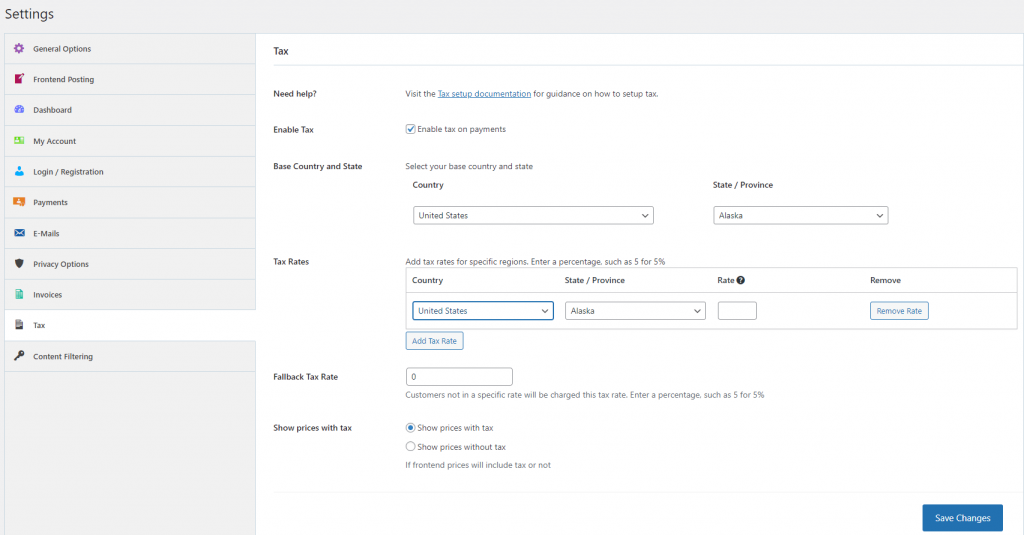

Navigate to wp-dashboard→User Frontend→Settings. Next, click on the Tax page to open it.

Here you'll get several options to set up the tax rates globally for your subscription packs.

Below are the subscription tax configuration steps you need to follow:

- Tick the checkbox of Enable tax [Enable Tax on Payments].

- Select your Base Country and State from the given drop-downs. The Base Country is where your business or company is located.

- Define the tax rates for specific regions that will apply to your users. Choose the Country and the State/Province from the drop-down. Then insert the Rate you want to apply. This drop-down menu is dynamic. The state/province will change depending on the country/region you choose.

- You can add several tax rates by clicking on Add Tax Rate. To remove any included tax rate simply click on the Remove Rate button.

- Include the Fallback Tax Rate for the user who has not specified his/her address in their profile, or is not belong to any of the regions specified by the admin of the site.

- Next, select the radio button whether you want to show prices with or without tax

- Finally hit the Save Button once you are done.

If you enable Show Prices With Tax, then your users will see the price of subscription packs after adding tax rates to the real price. The tax rates depend on the specified rates you've selected for the user's region or it will apply the Fallback Tax Rate.

Alternatively, if you select Show Prices Without Tax, the subscription packs will appear with the regular prices on the Subscription page. Later, during checkout, the user will see the tax rate that has been applied to him/her.

However, it's always better to consult with a legal advisor before implementing taxes on your transactions.

You can check our official documentation on how to Set Up Tax On Subscription Packs.

Read More: How to Set Dynamic Subscription Taxes Using WP User Frontend Pro.

Over to You

The subscription-based business model is getting popular all over the world. According to Statista, the subscription economy is projected to reach $1.5 trillion by 2026.

Companies that used to sell tangible products like elevators or mechanical equipment, now start selling intangible services, such as online monitoring and maintenance services.

Initially, even software was sold in CD-ROM as a tangible property that was easy to tax. But now developers and other organizations also offer subscription plans. The exchange of intangible goods makes the previous taxation rule invalid.

However, calculating the tax in Digital Economy is a major challenge for the subscription business. People are not still that much familiar with the sales tax compliance requirements for new services offered through the subscription model. In this case, the WP User front end can be an effective solution for your business.

Have any further queries regarding subscription tax? Share your thoughts in the comment section below.